Elevate Your Team's Experience with Employee Payroll Services

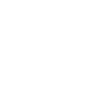

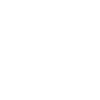

Welcome to Easy Source, where tackling your challenges isn’t just a service—it’s our passion. Unlike typical third party payroll outsourcing providers, we excel in delivering outcomes that go above and beyond your expectations.

We prioritize efficiency, cost-effectiveness, and ensuring a seamless experience throughout. Our mission? To not just resolve your payroll needs, but to exceed them with unmatched value.

At Easy Source, a payroll management company for companies, payroll outsourcing india and Manpower Outsourcing isn’t just about compliance and timely processing. We’re here to redefine exceptional Payroll Management Services in India, ensuring every interaction leaves you thoroughly satisfied and impressed.”

We are trusted third-party payroll partner, offering payroll services provider that go beyond basic compliance and timely processing. As a leading payroll services provider, we focus on efficiency, cost-effectiveness, and delivering exceptional value to redefine payroll management in India.